5amld Risk Assessment

The concept of money laundering is essential to be understood for these working within the financial sector. It is a process by which dirty money is transformed into clear money. The sources of the money in actual are legal and the money is invested in a way that makes it appear like clean cash and conceal the identification of the prison part of the cash earned.

While executing the monetary transactions and establishing relationship with the brand new customers or maintaining present customers the responsibility of adopting enough measures lie on every one who is part of the organization. The identification of such element in the beginning is easy to deal with as a substitute realizing and encountering such conditions later on in the transaction stage. The central financial institution in any nation offers complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to discourage such conditions.

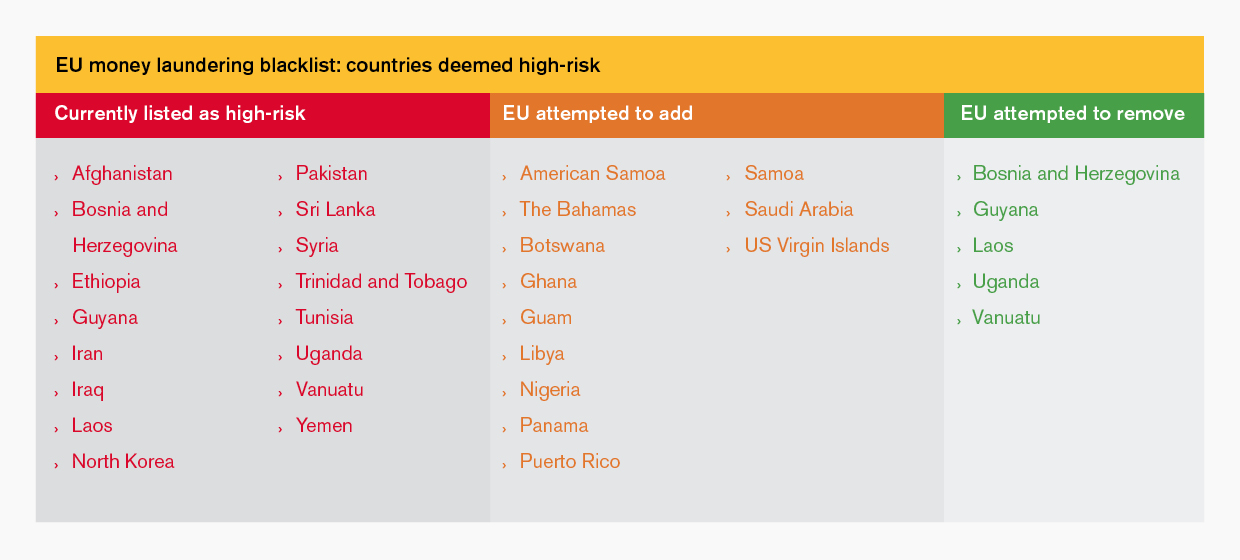

Get in touch AML Remediation Support. Moreover the EU Commission has recently published a relevant methodology for identifying such countries with strategic deficiencies in combating money laundering and terrorist financing.

Risky Business 5amld And Edd Global Risk Affairs

This risk analysis is conceived as a key tool to identify analyse and address money laundering and terrorist financing risks in the EU.

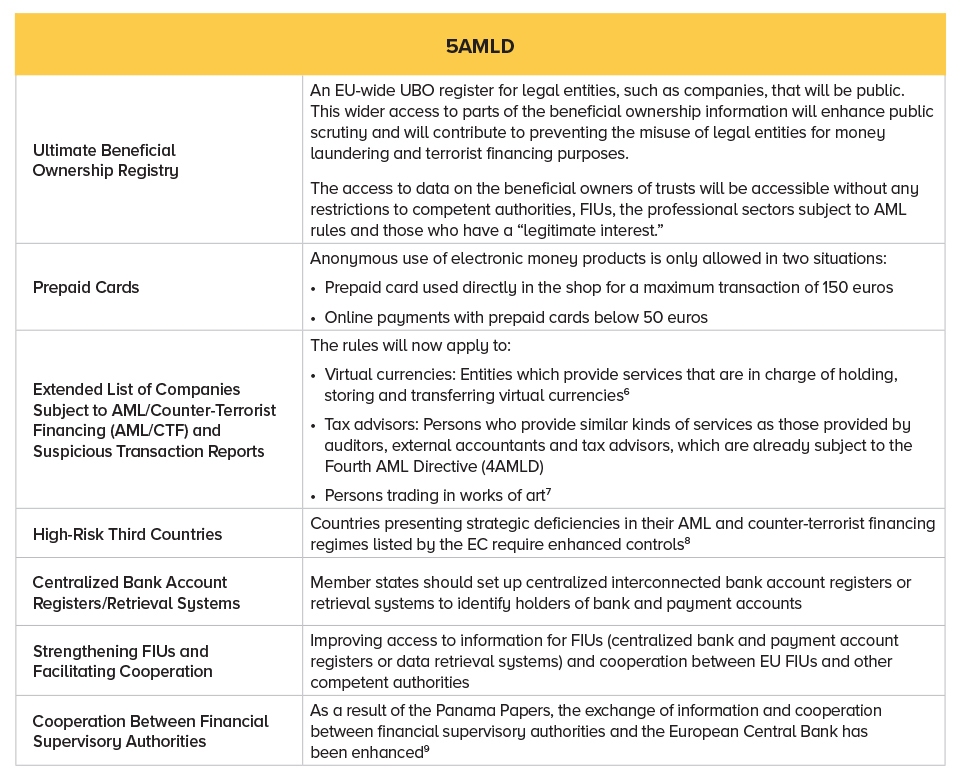

5amld risk assessment. The Commission argues that 4AMDL still leave gaps for instance with regard to. The measures require firms to. The 5AMLD came into force on January 10th 2020.

5AMLD EU 5th Anti-Money Laundering Directive AMLSC Anti-Money Laundering Steering Committee AML Anti-Money Laundering ARF Approved Retirement Fund AMRF Approved Minimum Retirement Fund. With the exception of casinos and following an appropriate risk assessment. Essentially the 5AMLD further raises the benchmarks for the practice of EDD on high-risk customers.

Ireland conduct a more comprehensive MLTF risk assessment of how legal persons and arrangements could be abused. It aims at providing a comprehensive mapping of risks on all relevant areas as well as recommendations to Member States European Supervisory Authorities and obliged entities to mitigate these risks. Innovations concern EDD in view of high-risk third countries ultimate ownership information transparency of funds and scrutiny of political exposed persons.

5AMLD sets out a series of measures to counter the financing of terrorism in addition to the just recently adapted 4AMDL. On July 5th 2016 the Commission published a proposal for 5AMLD. High-Risk Third Countries.

Fifth Anti-Money Laundering Directive. The 5th EU Anti-Money Laundering Directive in force as of 11 July 2018 includes amendments to the 4th AML Directive among them improvements in the assessment of high-risk third countries. One of the aims of the 4AMLD was to discourage firms from blanket screening their clients by introducing a risk-based assessment approach.

Companies that do business with customers from high-risk third countries are under 5AMLD required to perform enhanced due diligence measures specifically focused on addressing the deficiencies in those countries AML protections and the money laundering risks they present. The 5AMLD strengthens these changes including extending the scope to include all tax advisory services art dealers letting agents virtual currency exchanges and custodian wallet providers and introduces new measures including the following. Actions your firm needs to take to ensure you are aware of and compliant with new regulations and directives such as 5AMLD and 6AMLD.

The implementation of the Fifth Anti-Money Laundering Directive 5AMLD at the start of the year and the newly updated UK National Risk Assessment were long awaited updates that will help to drive positive change within the financial sector and beyond. Risk Management As before Firms are required to apply a risk -based approach when apply AMLCFT measures. A Firm should identify the risk the Firm is potentially exposed to given its particular business which in turn will assist in assessing the risk from transacting with a customer or performing an occasional transaction.

The authoring of an AML risk assessment Enterprise Risk Assessment and Client Onboarding Risk Assessment.

5amld Checklist 7 Steps To Help You Meet Compliance By Trulioo The Regtech Hub Medium

5amld The Fifth Anti Money Laundering Directive With Images Money Laundering Anti Company Logo

You Absolutely Have To Know These 6 Facts About 5amld Basis Id

5amld 5th Anti Money Laundering Directive High Risk Third Countries

You Absolutely Have To Know These 6 Facts About 5amld By Basis Id Medium

A Guide To The Eu S 5th Anti Money Laundering Directive Amld5 Sygna

What Does Europe S Anti Money Laundering Overhaul Mean For Trade Finance Global Trade Review Gtr

5amld How The New Eu Legislation Will Affect Crypto Business Payspace Magazine

12 Europeanframework Table2 Acams Today

What Does Europe S Anti Money Laundering Overhaul Mean For Trade Finance Global Trade Review Gtr

5 Steps Into The 5th Anti Money Laundering Directive 5amld Coinfirm

5amld Implications For Cryptocurrency

Risky Business 5amld And Edd Acams Today

The 5th Aml Directive Expected Changes To Local Legislation

The world of regulations can look like a bowl of alphabet soup at occasions. US cash laundering laws aren't any exception. We have now compiled a list of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting agency centered on defending financial companies by lowering danger, fraud and losses. Now we have massive financial institution experience in operational and regulatory threat. We have a powerful background in program management, regulatory and operational risk in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many antagonistic penalties to the group due to the dangers it presents. It increases the chance of major dangers and the opportunity cost of the bank and finally causes the bank to face losses.

Comments

Post a Comment